What’s the Difference Between a CMA and an Appraisal Report?

You are thinking about selling your home and you don’t have a good idea about the fair market value. There are several ways you can obtain more information. The most common is likely speaking with a local realtor (or several) who will provide a CMA – Comparative Market Analysis. Perhaps you don’t want to go with a realtor and try to sell on your own. Please don’t make the mistake of relying on Zillow to determine the value of the house. Zillow may have you thinking of an inflated value or worse, you might be leaving money on the table. The last and most informative option is to hire a licensed appraiser who will provide an accurate home appraisal report.

Of course, you could get both a CMA and an appraisal report if you are looking to sell you home. So, what is the difference between a realtors CMA and an appraisal report by a certified license appraiser?

Comparative Market Analysis (CMA)

A CMA is provided by a realtor. The first thing they will do is go to your home and take some notes. They will look at the room count, style, quality, and condition. They will also access the online tax records to obtain information like the home’s square footage, lot size, age, and taxes. They have access to the MLS (Multiple Listing Service) and will select comparable homes in the market and enter them into their sales grid. This is a grid that will provide a general ballpark of the value, depending on the relevancy of the comparable sales selected. If there are not a handful of very similar sales that have sold recently, the CMA becomes less dependable. A benefit of the CMA is working with a local realtor who may know the market well and there is no cost to have a CMA completed. A CMA can provide some good information, however there are a lot of details that are excluded as compared to an appraisal report.

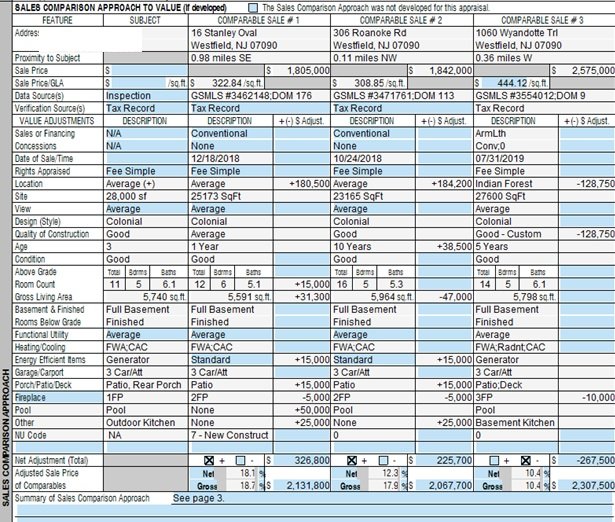

The biggest factor and difference between a CMA and an appraisal report is that a realtor is not qualified to make appraisal adjustments.

Adjustments are quantitative monetary changes made to the sale price of comparables which will assist the appraiser in reconciling fair market value.

Home appraisal report

An appraiser will go to your home and measure the exterior to calculate the square footage of the home. The tax records are not always accurate. The appraiser will take photos of the interior and exterior and also look at the condition, quality, and style. Notes will be taken on basement finish, central air conditioning, garage bays, exterior amenities, and more. The appraiser will also select similar comparables to the property being appraised and make adjustments for all of these differences. After the adjustments are made, the appraiser can review the adjusted values of the comparables selected and determine a fair market value.

The benefits to a home appraisal report:

Accurate fair market value of the home

Knowing where the banks appraisal value from the buyer will land

Having valuable data when it come times to negotiate the sale or purchase

The value may come back higher (in the thousands) than what you were expecting

Obtaining a private appraisal report will be for your eyes only. In other words, the information from the appraisal will not be shared with any other parties. This includes the town for assessment and taxes, the potential buyers or the potential sellers of the home.

Realtors are valuable resources and perform an important role in the real estate industry. Another difference between a realtor and an appraiser is realtors have skin in the game. Meaning, they may tell you strategies to list high to leave room to negotiate, or to list low and draw demand. An appraiser is an independent third party providing an objective unbiased fair market valuation. When it comes to selling your home, make the intelligent decision of knowing the fair market value by calling American Realty Appraisals at 908-233-1337.