Is Zillow’s Zestimate Accurate? - Appraiser Answers

Would you ever leave the value of your home to luck? Maybe I’ll list my home at $10,000,000 and see if I get lucky.

If appraisers were like the cable guy, I’d provide a window of value and tell you your home is worth between $400,000 and $800,000 :). Zillow’s range of accuracy can be like this or worse. On the first day of class at Appraising 101, the instructor stated “appraising is an art, not a science.” Zillow is a science, solely based on statistics. Sometimes Zillow’s zestimate is relatively reasonable, however sometimes it is significantly off, and it can be as unreliable as the cable guy.

Let’s take a closer look to answer – is Zillow’s zestimate accurate?

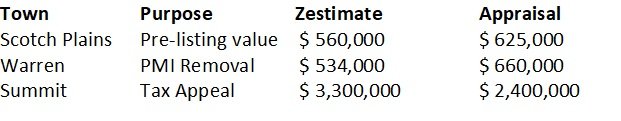

Here are three recent appraisals I performed:

If these homeowners relied on Zillow, the first homeowner would be leaving $65,000 on the table if they listed it at $560,000 and accepted an offer right away. Considering this homeowner purchased their home for $605,000 several years ago in a market that has gone up slightly, it is evident that there would be a small amount of appreciation.

Zillow doesn’t know the second homeowner in Warren just completed a $150,000 renovation. They can now get rid of the monthly Private Mortgage Insurance (PMI) charge on their mortgage. PMI is charged when a homeowner puts less than 20% down when purchasing a property and it is a way for the bank to mitigate risk. When questioning “is Zillow’s zestimate accurate?”, understand that they have not been inside anyone’s home and therefore the interior condition is assumed. Whether a home is completely dated or freshly renovated can significantly impact the value of the real estate.

Finally, and most surprising, Zillow is acting like it is 2005 on this Summit property. The township has the third home assessed at $2,900,000 and there is full support for a value of $2,400,000. The homeowners will be saving about $8,000/year on taxes. If the township were to rely on Zillow for taxing this property, that would mean the taxes would go up even more than the high amount that they are paying currently.

If you feel that your taxes are too high, don’t try to confirm your assessed value with Zillow, instead consult with a real estate appraiser.

For the most reliable and accurate value of real estate, it’s best to hire an appraiser.

Banks often order a ‘drive by’ appraisal when the homeowner has a lot of equity in the property and they are looking to take a small home equity loan out. The risk is far less to the bank in this situation. Perhaps in a scenario like this, banks can use Zillow where the accuracy of the value is not as critical.

If you need a real estate appraisal, whether it is for buying/selling, divorce, estate planning or a tax appeal, you may be wondering – is Zillow’s zestimate accurate? This article should clear things up and help you make a more informed decision to refrain from relying on an algorithm. Call American Realty Appraisals for the most accurate real estate valuation results at 908-233-1337.