A Home Appraiser’s Sales Comparison Approach to Determine Fair Market Value

As a real estate appraiser, I’ve been asked many times what my approach is to determine fair market value. While there are three main approaches to value (income, cost, and sales comparison), for residential appraisals the sales comparison approach is almost always used. The other two approaches are more often used for income producing properties and unique structures.

Inspect the property

The sales comparison approach uses other sales to compare to the subject property. Ideally, the sales used are similar homes that have recently sold and are in close proximity to the subject. Before I research for comparable sales, I first inspect the property. It’s important to have a good understanding of the subject property in terms of style, location, size, quality and condition. Once I know this data, I will go on the Multiple Listing Service (MLS) to search for the comparables or “comps.”

Select the best Comparables

When researching for comps, I will start by selecting some parameters to narrow down the results. Depending on the area, I may start by selecting the style and bedroom count and search back for the past 6 months. Then I may narrow it further by selecting the immediate neighborhood of the subject to find the best comps available. More often than not, I will have to expand these parameters to collect more data and find similar comparables as that search criteria is pretty narrow and limits the results.

If the goal is to determine the current fair market value, I will also research comparable active listings as well as similar homes under contract. If the goal is a retrospective fair market value, as in one that is dated back in time, then I will only use closed sales. Examples of this would be for estate planning and a valuation as of the date of death, or a tax appeal with a valuation as of October 1st of the previous year.

Make adjustments

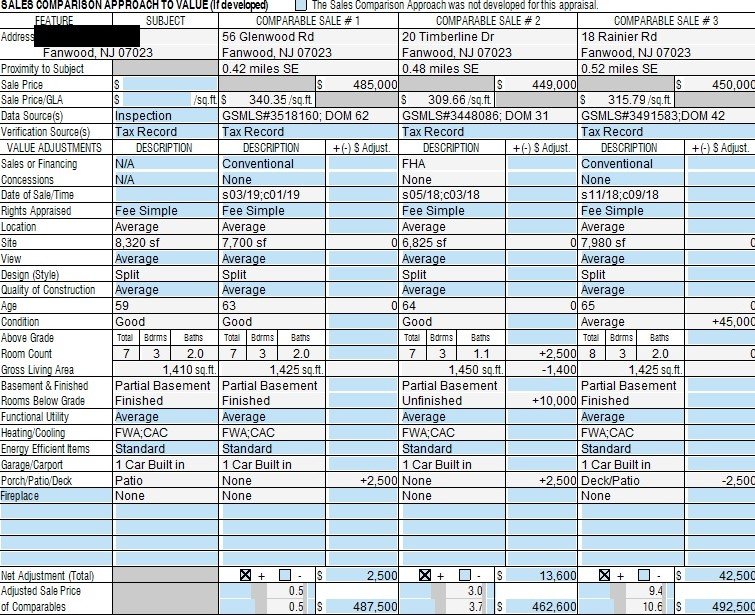

Once I select the best comparables, I will fill in the “grid” in the sales comparison approach. As you can see in the image below taken from an appraisal report, there are different line items are that important to consider. The top half of the grid is more important than the bottom half. The top half has line items for date of sale, location, lot size, style, quality, age, condition, and square footage. The bottom half has items like basement, heating and cooling, garage, exterior amenities, and fireplace. There are extra spaces below to add items like pool, tennis court, elevator, accessory unit, and other less typical features.

Adjustments are made for each line item that differs from the subject enough that it warrants an adjustment. In this example, the lot sizes are different, but they are close enough that someone in the market would not consider these differences to be significant. The condition of comparable 3 is significantly different and therefore a 10% condition adjustment has been applied. Once all of the adjustments have been made in the sales comparison approach, the appraiser will reconcile the final value.

Reconcile the value

When reconciling the final value, the appraiser takes into consideration all of the factors presented in the grid. They may also look at the bottom of the grid where there are two numbers on top of each other by the adjusted price. These numbers are the net and gross percentages. The lower these numbers are, the more similar the property is to the subject and the more weight that should be given to these comparables when factoring in the final value estimate.

If you are looking to determine the fair market value of your home, the sales comparison approach by a certified licensed appraiser is your best bet for the most accurate opinion of value. Please don’t hesitate to give us a call for any of your appraisal needs at 908-233-1337.